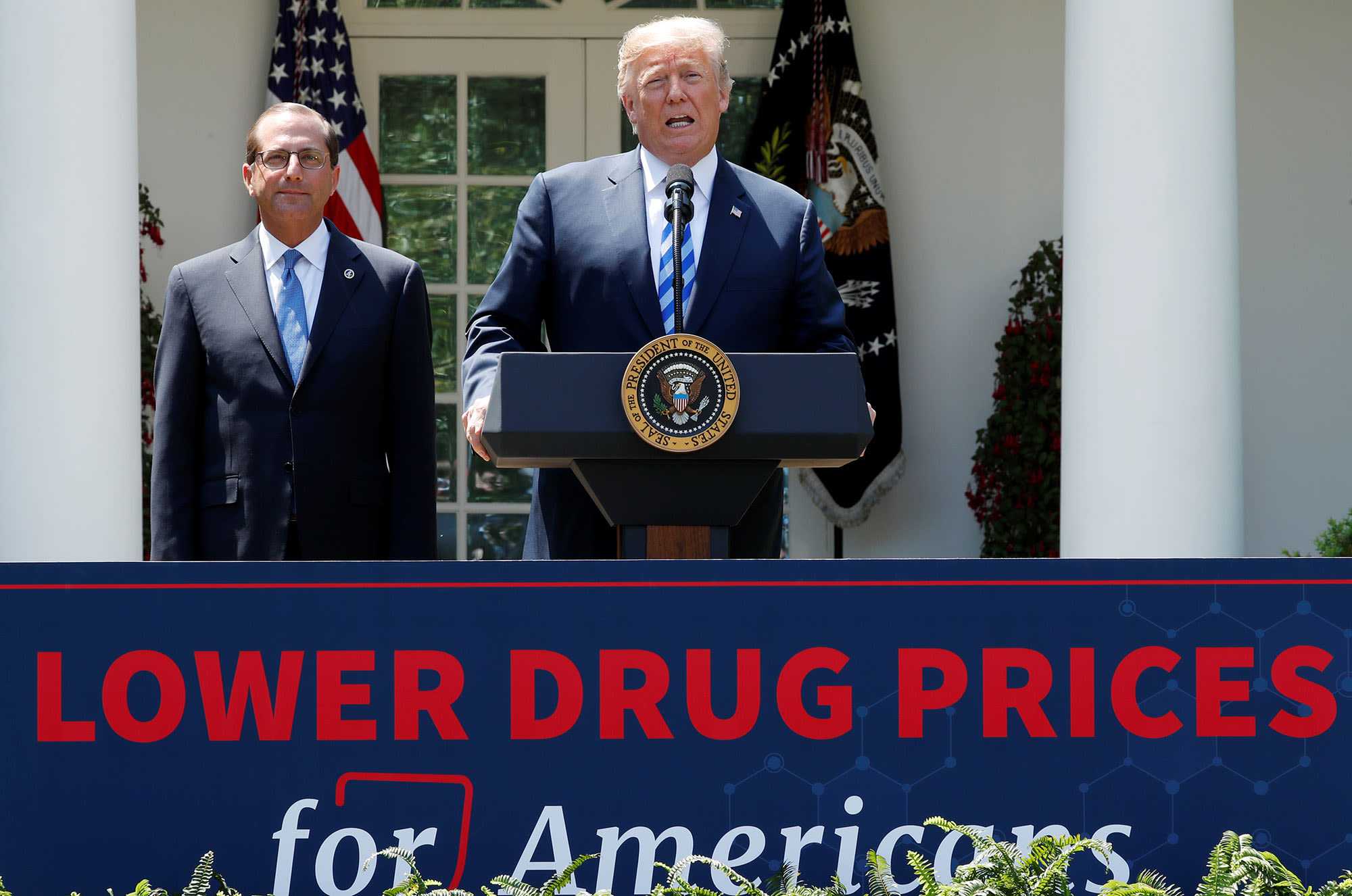

Health and Human Services Secretary Alex Azar listens as U.S. President Donald Trump delivers a speech about lowering prescription drug prices from the Rose Garden at the White House in Washington, U.S., May 11, 2018.

Jonathan Ernst | Reuters

CEOs from the world’s largest pharmaceutical companies pitched ideas for lowering drug prices at the J.P. Morgan Healthcare Conference in San Francisco this week. None, however, offered to cut prices on any of their own drugs.

Some of the executives, like Regeneron CEO Leonard Schleifer, suggested making changes to Medicare, the federal government’s health insurance plan for the elderly, by adding an out-of-pocket maximum for beneficiaries. Others, including Pfizer CEO Albert Bourla, supported passing rebates paid to pharmacy benefit managers through to consumers, arguing the current system drove up list prices and out-of-pocket costs.

“We were disappointed that eventually the plans [in Washington] to have reformed the rebate [system] didn’t materialize,” Bourla said in an interview with CNBC’s Meg Tirrell on Tuesday.

They also faulted hospitals and insurers. During a panel on drug pricing reform Tuesday evening, Bristol-Myers Squibb CEO Giovanni Caforio and Roche CEO Bill Anderson blasted hospitals for marking up the price of medicines, sometimes by triple-digit percentages. Caforio specifically called the practice “extraordinary.”

“That’s not helping” patients, Caforio said. “That’s a good example of how you have to look at the entire system.”

Eli Lilly CEO David Ricks blamed health insurers for high drug costs, arguing that they ultimately determine what patients pay at the pharmacy counter.

“We’ve built insurance designs that make insurance more affordable for more people but have less benefit to those who are sick,” Ricks said during a fireside chat at the conference Tuesday. “We need reform to the insurance system, so we avoid these upside-down economics for patients.”

Executives at the conference, the biggest health-care investing event of the year, largely stuck to the same arguments they used last year to fend off attacks from Congress and the Trump administration to crack down on high prescription drug prices. It likely serves as a preview of Big Pharma’s stance on health-care costs in 2020.

Health costs in 2019 saw their largest gain in 12 years, rising 4.6%, the Labor Department said this week. In December alone, health costs jumped 0.6% after rising 0.3% in the previous month, boosted by a 2.1% acceleration in prices for prescription drugs as well as consumers paying more for hospital services and doctor visits.

House Speaker Nancy Pelosi is pushing drug pricing legislation that would allow the government to negotiate lower prices with pharmaceutical companies on the costliest drugs each year. In the Senate, Republican Chuck Grassley and Democrat Ron Wyden are working on a bill that would cap drug pricing increases at the rate of inflation, among other measures. President Donald Trump is also looking to enact changes.

Despite the threat of policy change out, drugmakers rang in the new year by hiking the list price on more than 200 drugs.

When asked about the increases, executives at the conference said the cost of drugs in the U.S. health-care system represented only a small fraction of overall costs. They agreed that something needed to be done legislatively about the high costs seniors pay for medicines and mentioned their copay coupons and other forms of assistance.

Some expressed doubt that sweeping drug pricing legislation like Pelosi’s would ever become law.

“We don’t believe that some of the more radical solutions will take hold,” Regeneron’s Schleifer said.

–CNBC’s Kevin Stankiewicz contributed to this report.