Dallas Federal Reserve President Robert Kaplan said he’s comfortable with where interest rates are but thinks the central bank needs to talk this year about the size of its balance sheet.

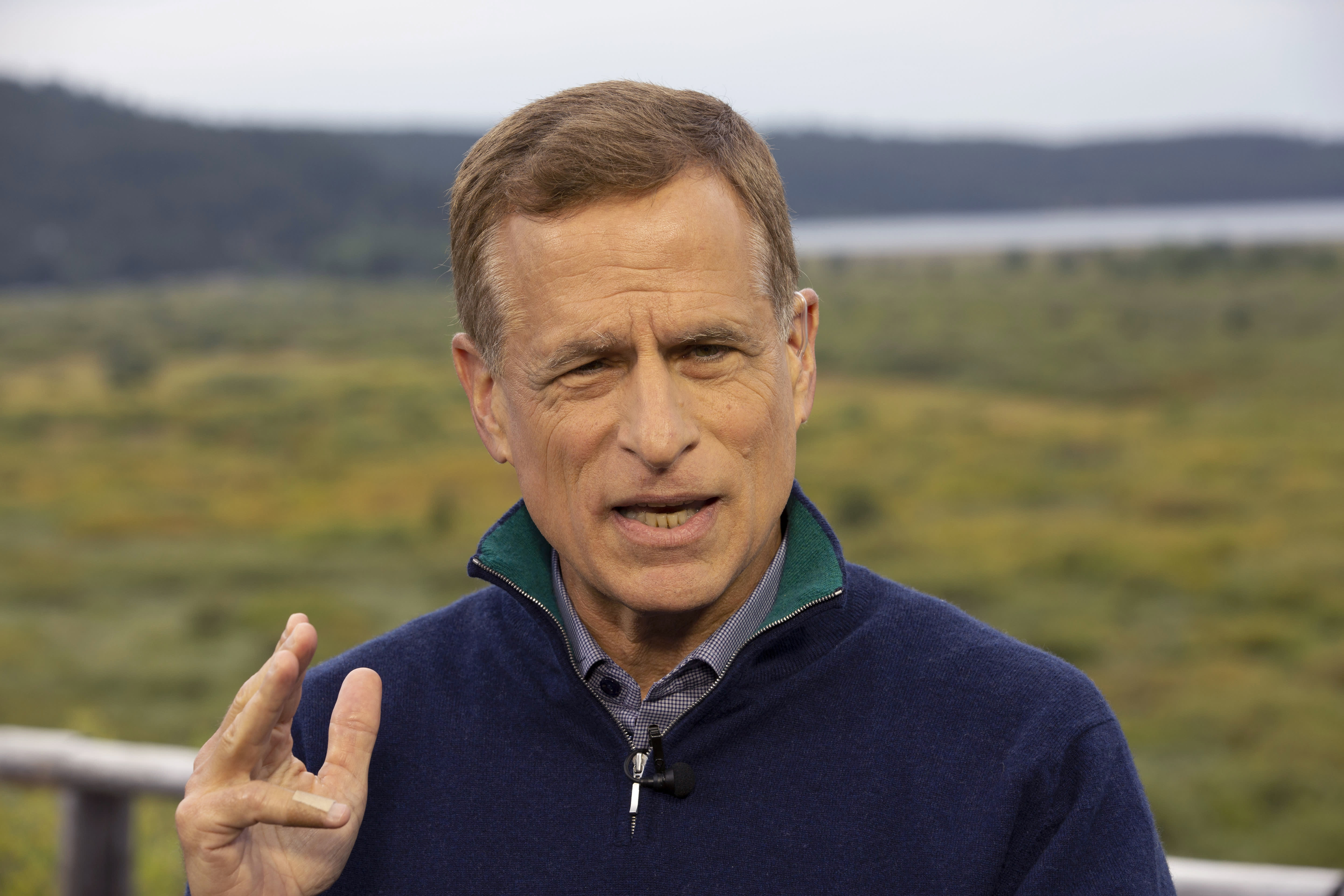

In an interview Friday with CNBC’s Steve Liesman, Kaplan said economic growth is likely to grow in excess of 2% this year while inflation remains low, justifying the Fed’s stance of likely keeping its benchmark overnight borrowing rate anchored in a range of 1.5%-1.75%.

“I don’t think we should be making any moves at this point on the fed funds rate,” he said during an interview on “The Exchange” and aired from the American Economic Association conference in San Diego. “We’ll keep revisiting that as the year goes on.”

An issue that could get more immediate attention is the Fed’s balance sheet, which consists primarily of a portfolio of bonds it has purchased since the financial crisis. After two years of reducing its holdings, the Fed has started buying again to quell volatility in the overnight borrowing market, or repo, and to keep its rate within the target range.

The balance sheet has since ballooned to more than $4.2 trillion, and Kaplan said he is concerned.

“Now that we’ve gotten past year-end, I want to find ways to grow the balance sheet more slowly,” he said. “That would be my objective. I’m sure there will be disagreements about that.”

Kaplan also addressed the U.S. strike Thursday against Maj. Gen. Qasem Soleimani, head of the Islamic Revolutionary Guard Corps’ Quds Force. While oil prices rose Friday, the gains were somewhat subdued, something Kaplan attributed to the U.S. and its ability to achieve energy independence.

“I think you would have gotten a different reaction 10 years ago, certainly 20 years ago,” he said. “We’re much more energy self-sufficient. Because of that, you see these events in the Middle East, they’ll have an effect, but it’s going to be more muted than we might have seen historically.”