The father of passive investing told CNBC on Thursday that the shift toward index funds has vindicated his ideas and that there is still too much active management.

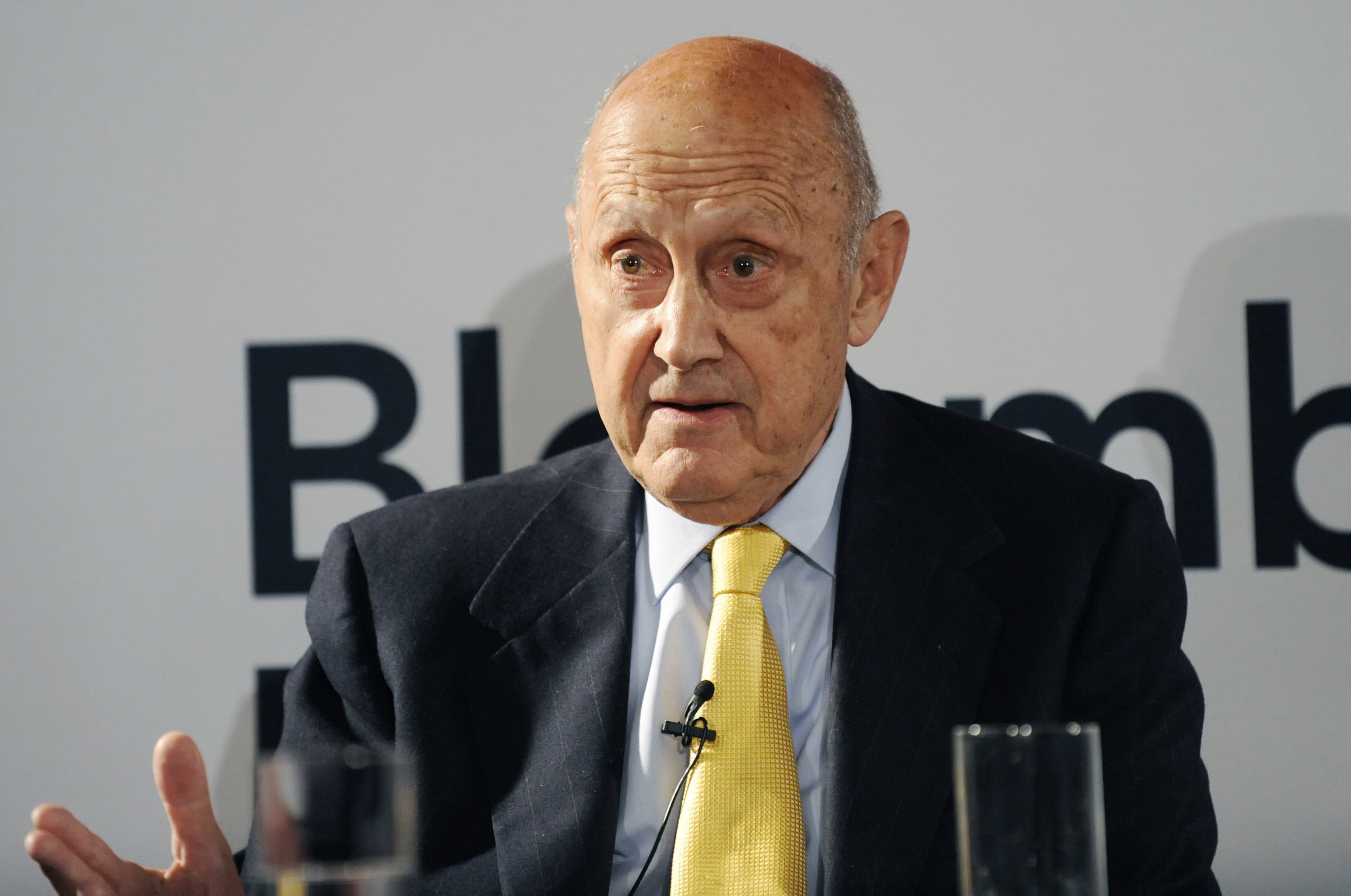

Burton Malkiel is an emeritus professor of economics at Princeton University and author of the famous investing book, “A Random Walk Down Wall Street.” He said on CNBC’s “Squawk on the Street” that his idea that most investors should invest passively was originally met with ridicule.

“When my book was first reviewed by a professional in Businessweek, they said it was the biggest piece of garbage in the world, ridiculous advice,” Malkiel said. “Well, now in mutual funds the index share is now more than 50% and the active share is less.”

Malkiel’s book, published in 1973, influenced the thinking of many industry leaders who pioneered index funds, including Vanguard’s Jack Bogle. Malkiel has also served on the Vanguard board of directors.

Malkiel’s theory is that investors are better off buying a broad universe of stocks and minimizing fees rather than paying an active manager who may not beat the market. This idea is embodied by ETFs that track major stock market indexes, such as the S&P 500, and passive mutual funds.

Passive investment has been closing the gap on active management over the decades, making a big leap following the financial crisis. However, Malkiel said there are still too many investors who are not taking advantage of passive investing.

“I think, frankly, it has been proven. It does work, and frankly, I think there’s even too little indexing now. There ought to be even more indexing,” Malkiel said. “It works. It’s the best thing for individual investors to do for the core of their portfolio.”